https://dynamicbusiness.com.au/topics/news/leverage-crypto-traders-lose-over-us13-billion-in-2020.html

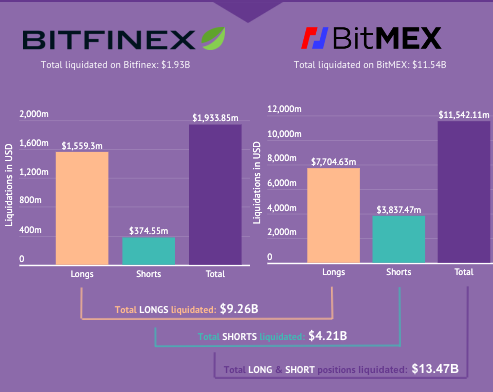

Data from cryptocurrency trading simulator Crypto Parrot has found that cryptocurrency traders on Bitfinex and BitMEX lost $US13.47 billion in 2020.

The data found that $US9.26 billion of long positions and $US4.21 billion of short positions were liquidated over 2020.

Crypto shorting is a bet that the price of a certain crypto asset will fall, enabling the trader to pocket a profit when the price drops. Going long entails the opposite, whereby a trader bets that prices will rise.

However as the price of Bitcoin dipped and rose, many traders liquidated their positions and lost money.

Much of this can be attributed to the wild volatility that Bitcoin has experienced this year.

“The March decline in Bitcoin price was unexpected as it came in the wake of a black swan event. The asset’s value simultaneously plunged alongside stocks, gold, silver, and other legacy markets,” stated the Crypto Parrot research.

“However, gold, stocks, and Bitcoin recovered after central banks rolled out pandemic stimulus packages. With Bitcoin, it is premature to expect a similar movement from a black swan event.”

A black swan event is an unpredictable event with severe consequences.

The arrival of COVID-19 wreaked havoc across the global economy. Stockmarkets plummeted, unemployment soared and country after country recorded recessions. The IMF estimated that the global economy may shrink by 4.4 per cent this year.

In March the price of Bitcoin plummeted, dropping below $US4,000.

However its price has surged once again and is currently trading at an all time high at approximately $US26,830 (as at December 30).

Demand continues to be driven up as Bitcoin receives more mainstream acceptance, with financial services PayPal and Square facilitating Bitcoin transactions and investors using Bitcoin as a hedge against inflation.

Most of the liquidation tracked by Crypto Parrot’s data has occurred in Ethereum.

As the ETH 2.0 upgrade was set to roll out at the end of November, increasing demand spiked the price of Ethereum to $US620 on 24 November. However on 26 November the price dropped to $US480, causing a mass liquidation.

“With the high liquidation amount, traders have attempted to avoid using excessive leverage when trading futures contracts,” stated the Crypto Parrot research.

“It exposes capital to unnecessary risk especially with some exchanges managing liquidations very aggressively.

“Therefore, most traders are relating to the insurance fund to avoid massive losses.”

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.