https://www.economist.com/node/21787939?fsrc=rssbus

TENCENT, THE world’s biggest gaming company, gives away most of its video games for nothing. Lest anyone think that the Chinese tech giant, which has a market value of $580bn, has a heart of gold, think again. It makes most of its gaming sales by encouraging players to buy virtual clothing, weapons, explosives and the like. These are usually cheap but prices increase depending on their cosmetic appeal or effectiveness in blasting an opponent to smithereens. For reasons known only to gamers, they willingly pay. During the lockdown in China, gaming revenues soared.

In the real world, that same scattershot purchasing model is one that Tencent has used to build, stealthily, a bridgehead in the global gaming industry. This year it has taken stakes in two Japanese games developers. Last year it took control of Supercell, a Finnish creator in which it had already invested about $8.6bn. It owns 100% of Riot Games, American publisher of “League of Legends”, and in the past decade has amassed stakes in more than a dozen other of the world’s hottest game developers, including Epic, owner of the smash hit “Fortnite”. According to Technode, which reports on Chinese tech firms, in that time it has made more than 100 other investments in fintech and artificial intelligence, particularly in America. It has stakes in household names such as Tesla, Uber, Snapchat and Spotify, and opens its chequebook for digital pioneers in India and the rest of Asia. Yet unlike other Chinese-owned, globe-spanning firms such as Huawei and TikTok, it rarely faces the sort of public backlash that has grown common as a result of America’s tensions with China. Its unique approach to international gaming helps explain why.

Until recently, Tencent’s gaming acquisitions overseas looked more like disparate bets than part of a strategic master-plan, which helped keep them under the radar. That is because Tencent’s main focus has always been China, where WeChat, its chat service-turned-superapp of 1.2bn users, drives traffic for gaming, streaming services such as music and video, digital payments and business services, as well as generating copious advertising. Gaming has long been Tencent’s biggest cash generator. Though its share of revenues is falling as Tencent diversifies into the business market and fintech, its high profitability remains crucial for keeping the wheels of the digital leviathan running. The company controls more than half of China’s $33bn gaming market, and has helped pioneer gaming on smartphones, where China leads the world. For foreign gaming companies that receive its cash, one of the main attractions has been to go into partnership with Tencent to bring their games into China.

Notwithstanding the first-quarter surge, gaming growth in the Middle Kingdom is no longer setting the blistering pace of a few years ago and, as so often in China, the state has intruded. In 2018-19 the gaming industry was kneecapped by President Xi Jinping’s crackdown on online addiction, blood, butchery, boobs and bums (there are rules for how much skin a female avatar can show). Faced with domestic headwinds, David Dai of Bernstein, an equity-research firm, says Tencent will quintuple gaming revenue from overseas from a pittance last year to about $3.5bn in 2021. It will do that by building on partnerships with foreign firms in which it holds stakes to make mobile games for the global market. Last year one of its studios developed a mobile version of “Call of Duty”, Activision Blizzard’s PC and console blockbuster. It was the biggest launch of a mobile game ever. This year, it is working with Riot to launch a smartphone version of “League of Legends”, the most popular desktop game in history. Ultimately, as a Tencent insider puts it, the dream is to “go it alone”; ie, to produce a Tencent game somewhere in the world that is a global hit.

If that happens, Tencent’s higher profile will generate a bigger risk of geopolitical flak, even if gaming is hardly a strategic threat to anyone. Yet the way it operates its sprawling empire may provide it with cover. Tencent stands apart from many Chinese firms by the freedom it gives the companies it invests in to act with autonomy, to compete fiercely against each other (and Tencent itself), and by promising to keep most of their data out of its clutches. This is particularly true in gaming, says Steven Messner, a specialist on Chinese gaming at PC Gamer, an industry publication. “It is not in the business of telling companies what to do.”

Some investors would like it to be more proactive in knitting its disparate strands together, to cash in more effectively on people’s data and boost its advertising revenues. Some grumble on Reddit, a fire-hose of gamer chat (in which Tencent also owns a stake), about the risks its acquisitions pose of bringing China’s bossy regulations to their anarchic pastime. But so far its global gaming investments have been spared the scrutiny from American authorities which other big Chinese firms have faced. If they focus at all on Tencent, it is on WeChat, because of allegations it is used to support surveillance and censorship in China. Yet WeChat is not used with gaming in the rest of the world. One reason for the China hawks’ relaxed attitude may be because of Tencent’s strategically ambiguous and hands-off approach to its gaming assets.

Brother, can you spare a Tencent?

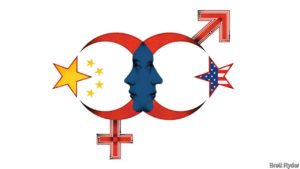

In fact, Tencent could be a force for good if it promotes mobile gaming globally. More than two-thirds of Chinese gamers play on their smartphones, compared with just over a third of American ones; the latter have five years of catching up to do. Tencent also hopes to develop cloud-gaming, in which 5G smartphones and faster connectivity enable players to stream games as easily as films, and increase use of augmented and virtual reality in mobile gaming. The trouble is that its partner in both endeavours in China is Huawei, which will raise hackles in America. Expect to hear more about Tencent’s global gaming prowess in the future. Tencent, of course, will hope that this attention is not because it, too, gets caught up in Sino-American bangs and explosions.■

This article appeared in the Business section of the print edition under the headline “The great game”